TTC Land – Profit before tax in 2019 reaches VND 347 billion – The highest it has ever recorded

According to the Financial Statement of Q4 2019, TTC Land profit before tax in 2019 reaches VND 347 billion- the highest it has ever recorded, increasing 12% over the same period. Profit after tax is VND 288 billion, increasing 39% compared to VND 208 billion in 2018.

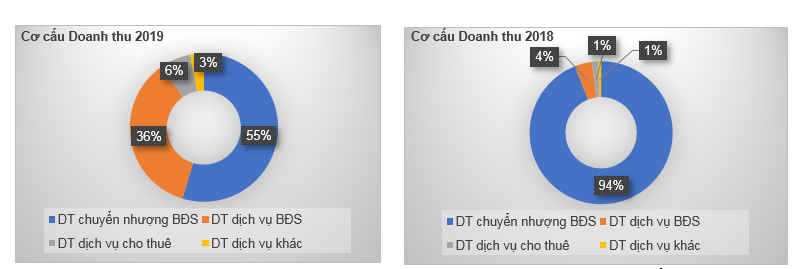

Although the net revenue in 2019 does not reach the target but records a figure of VND 1,031 billion, the revenue structure has a significant move when the proportion of real estate services revenue increased by 223%, accounting for 36% compared to 4 % of 2018. Revenue in real estate transfer accounts for 55% compared to 94% in the same period. TTC Land also records revenue from rental services and other services, which increases by 68% and 48% respectively and in the revenue structure and these ones account for about 7% and 3%. Thus, TTC Land's revenue in 2019 mainly comes from the handover of existing projects including: Jamona Home Resort - Thu Duc, Jamona City, Jamona Golden Silk – District 7, Charmington La Pointe – District 10, Carillon 5 - Tan Phu district, etc., and real estate brokerage services.

Source: TTC Land

In addition to enhancing the increase of profit from core activities through handing over the project as committed, the Company also records VND 283 billion in financial revenue, increasing 38% over the same period. In Q3, TTC Land transferred the Hai Phong Project after nearly 18 months of holding, earning quite attractive profit. According to the Board of Directors, in the context of real estate market being legally tightened, the Company flexibly withdraws capital from affiliates that own small-scale projects in areas where TTC Land does not have competences or the not potential areas for immediate development to generate efficient cash flow. In Q4, the Company also transferred 20% of shares in Thanh Thanh Cong Industrial Park Joint Stock Company TTC IZ to bring significant revenue as well as ensure profitability from investments in the portfolio and actualize profit from investment.

Interest expenses, selling expenses and administration expenses have been significantly reduced by 18% and 36% over the same period while profit still exceeded the plan. Profitability ratios of TTC Land accordingly record positive numbers. EBITDA margin is 51%, EBIT margin is 47%, Gross profit margin is 41% and Net profit margin is 28%, which are all higher than the industry average rates. EBITDA margin and EBIT increase by 3 times, Gross Profit margin increases by 2 times and Net Profit margin increases by 4 times over the same period.

As of December 31st, 2019, total assets reached VND 10,885 billion, increasing slightly from the beginning of the year. The chartered capital remains at VND 3,392 billion and the equity is VND 4,784 billion, increasing 6% compared to 2018 due to the increase in undistributed after-tax profit of VND 632 billion. Inventory decreases slightly by 4% to VND 4,205 billion, accounting for 39% of total assets compared to 41% in 2018, mainly from unfinished real estate projects accounting for 99%, most of which are in key projects of 2020. This inventory will be converted into revenue when the Company officially hands over the products to customers in the coming years.

Short-term and long-term borrowings decrease by 4% and 11% compared to 2018, supporting the Debt / Total Assets and Debt / Equity ratios slightly decrease at 0.21 times and 0.48 times, which are lower than the same period and equivalent to the industry average ratios. Currently, the capital structure of the projects is on average ratio of 20% from equity capital, 35% prepayments from customers and 45% from loans. Short-term prepayments reach VND 1,231 billion, accounting for 12% of total assets, contributing to ensure that the capital structure is always in a safe level when the Company maintains positive sales volume. Current and quick payment ratios reach 1.8 and approximately 1, increasing slightly by 5% and 9% over the same period, ensuring that the repayment ability has been well controlled.

"Consolidation and Development" - 2,300 products will be launched to the market with revenue expected to grow strongly by 123%

Regarding of target in 2020, TTC Land's Board of Directors said it is expected that revenue and profit before tax will be about VND 2,297 and VND 390 billion, strongly increasing 123% and 13% compared to the implementation of 2019. Real estate market is forecasted to have positive changes compared to 2019, but the project’s legal issue is still strictly controlled. In this context, the company will focus on reducing costs from 20% to 30% compared to last year to maintain efficiently profitability ratios.

Mr. Nguyen Dang Thanh - Chairman of the Board of Directors of TTC Land made speech about the operation orientation in 2020 "Consolidation and Development"

With 5 key residential projects expected to be implemented in 2020 including: Charmington Iris – District 4, Charmington Dragonic – District 5 (Central Area); Charmington Tan Son Nhat (Phu Nhuan), Carillon 7 (Tan Phu) - western Ho Chi Minh city; Panomax (District 7) - southern Ho Chi Minh city, the company plans to launch about 2,300 products, marking an increase of 263% compared to the implementation of 2019. Sales result of 2020 is expected to reach 5,360 billion VND. In average, each product of TTC Land launching to market is worth about VND 2.3 billion. The total investment of these 5 projects is estimated at VND 10,119 billion serving the record of venue in the period of 2020-2023.

In the light of diversifying incomes, reducing risks depending on a type of real estate and deploying the residential real estate, TTC Land simultaneously deploys TTC Plaza Duc Trong - the first Commercial Center project in Lam Dong, and Charmington Tamashi Commercial – Hotel – Apartment Complex project in the center of Da Nang. In addition, revenue from Industrial Park real estate of which TTC is holding shares in the member companies is expected to continue to create a stable source of annual revenue for the Company together with commercial segment.