TTC Land (SCR) plans to raise capital by issuing shares, issuing ESOPs at a price of 11,000 VND per share, and paying dividends at an 8% rate in 2021.

TTC Land (SCR) expects to increase charter capital from VND 3,664 billion to VND 4,653 billion if the issuance is successful, while the current market capitalization is around VND 7,800 billion.

Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land – code SCR) has announced the report for the 2022 Annual General Meeting of Shareholders, which is expected to present to shareholders a series of share issuance plans, including an offering plan of shares for existing shareholders to increase charter capital. As a result, the company will issue nearly 51.3 million more shares at a price of VND14,000 per share (equal to 2/3 of the market price of SCR as of April 4), for a total mobilization value of more than VND 718 billion.

In addition, SCR will issue 29.3 million new shares to pay the dividend by shares at the rate of 8% in 2021. Furthermore, the company will issue an additional 18.3 million shares under the employee stock ownership plan (ESOP) at a rate of 5% on shares outstanding. The offering price is VND 11,000 per share, and the issued shares cannot be transferred within 1 year.

If the issuance is successful, SCR's charter capital is expected to increase from VND 3,664 billion to VND 4,653 billion. Meanwhile, the market capitalization of this real estate company is approximately VND 7,800 billion.

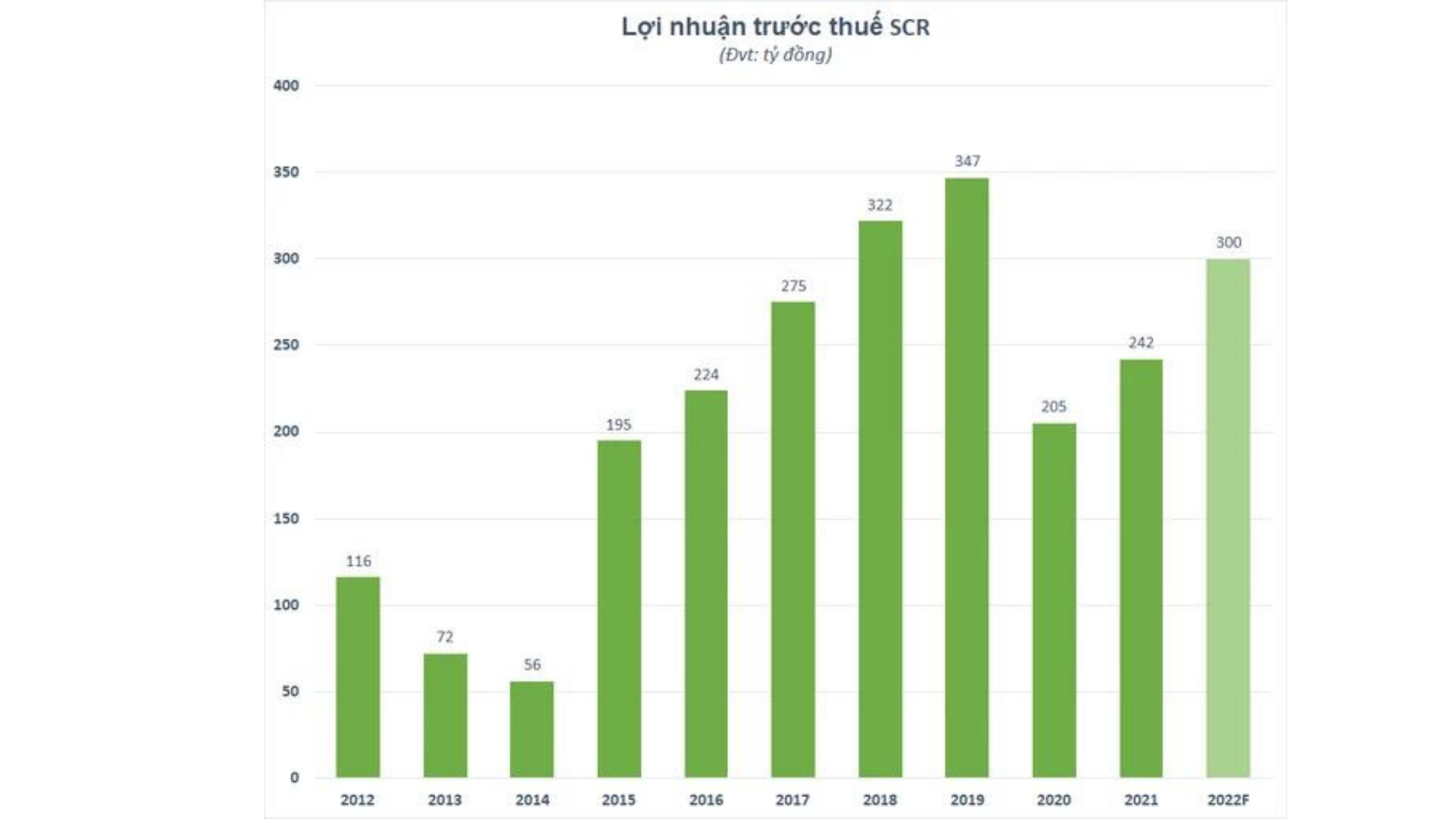

At the meeting, SCR will also present to shareholders a business plan with a target net revenue of VND 2,135 billion and profit before tax (PBT) of VND 300 billion, up 27 % and 24 %, respectively, from the implementation in 2021.

Previously in 2021, SCR generated consolidated net revenue of VND 1,683 billion, an increase of more than 83 % over the same period last year and 12 % of the year plan, attributed mostly to the handover of the Carillon 7 project.

However, there was no significant financial turnover from the transfer of Tin Nghia A Chau shares as it was last year, SCR's profit before tax increased by only 18 % to VND 242 billion, while profit after tax remained relatively flat at the same level of VND 194 billion.

In 2021, SCR implemented a number of prominent transactions, including acquiring an additional 11 % of capital at Long An Construction Investment - Idico (the company has a land fund of more than 130 hectares in Long An), bringing the ownership ratio up to 40.62 %; collaborating to develop a new project in Bien Hoa, Dong Nai with a scale of 160 hectares through the transfer 20 % shares of Phuoc Tan Company, etc.

Source Cafef