Which bank lends the most for real estate?

The rate of real estate lending over total credit has trended to decrease in recent years. Banks' disclosure figures show that the majority maintained this ratio under 7%, but others remained at a high level of 10-12%.

One week ago, Ho Chi Minh City Real Estate Association (HoREA) issued an official dispatch to the Prime Minister and the State Bank about the delay, should not apply the new regulation from January 01st, 2019 that the credit institutions can use maximum 40% of short-term borrowings for medium-term and long-term loans. Meanwhile, at a Resolution of August regular meeting, the Government once again asked credit institutions to control credit flows in the risky areas, including the real estate sector.

There are opposite opinions around this proposal, including the opinion that the State Bank should not step back with HoREA's proposal. The possibility of delaying the short-term borrowings rate for medium- and long-term loans is considered unlikely when the head of the banking sector from the beginning of the year has repeatedly released the dispatches to request Credit institutions to control credit on real estate. Recently, banks have been also urgently restructuring the maturity of funds to soon meet regulatory requirements. Real estate loan rate tends to increase and loan conditions are also becoming stricter.

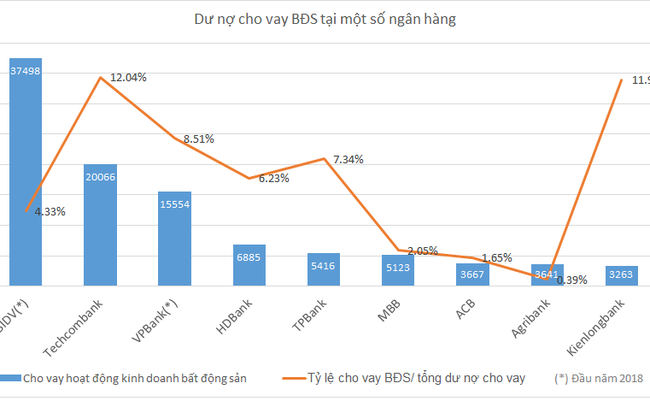

Statistics from financial reports of banks for the moment has shown that the real estate lending rate in most banks is on the increasingly downward trend. For example, in MB, real estate loans to the end of June this year only accounted for 2.05% of total outstanding loans, which is sharply down from 2.93% at the beginning of the year. HD Bank, the rate decreased from 7.19% to 6.23%; in TP Bank it decreased from 8.42% to 7.34%, in ACB the rate decreased from 2.1% to 1.7%, etc.

Some other banks have higher real estate lending rates, exceeding 10%, such as Techcombank and Kienlongbank

In the end of June, Techcombank's real estate loans was VND 20,066 billion, accounting for 12.04% of the total lending amount. This rate is also on the downward trend, from 12.64% at the beginning of the year. Meanwhile, real estate lending in Kienlongbank increased 31% to VND 3,263 billion, making the ratio of total outstanding loans increased from 10.01% to 11.9%.

Among the groups of bank recorded with high ratio of real estate loads is Sacombank. There is no specific figure, however, by the end of June, the bank had over VND 42 trillion in outstanding loans for asset management and consulting services (accounting for 17% of total loans). Most of these loans are for real estate business.

It was not updated until the end of June, 2018, but according to statistics earlier this year, BIDV and VP Bank are also banks with quite big outstanding real estate loans for the moment. Specifically, in early 2018, real estate credit of BIDV is VND 37.498 billion, in VP Bank's is more than VND 15,500 billion. Although the absolute number is quite high, but comparing with the huge total outstanding loans, real estate lending rate at BIDV is only at 4.33%. At the same time, the rate at VP Bank was 8.51%, which is still higher than the average rate of other banks but decreased sharply from one year ago (down from 11.71%).

Nonetheless, in other statistics recently released by BVSC, BIDV is the bank owing biggest market share in real estate and mortgage lending and the next one after is Techcombank.

Banks' financial statements show that the majority maintained their real estate lending rates below 7%. This rate has fallen sharply from over 30% in 2007-2008. The figure published by the State Bank also showed that the real estate credit ratio of total outstanding loans of the economy at the end of June was only around 7.5%.

However, the actual proportion of real estate loans on the total outstanding loans of the economy is still controversial. Many people argue that real estate loans in banks are now mostly hidden under the form of consumer loans. The proportion of real estate loans can be much higher than the level announced by the banks.

In fact, home loan in the form of consumer credit has been growing rapidly in recent years. According to statistic from the National Financial Supervisory Commission in 2017, consumer credit grew by 65%, accounting for 18% of total credit. In particular, loans for the purpose of buying and repairing houses accounted for 52.9%. Doctor. Canh Van Luc, BIDV's chief economist, recently had to propose to separate home loans, home repairs from consumer credit, and real estate loans under some certain conditions

Many experts say that tightening real estate credit will not only be instantaneous but a long-term trend. Other sources of capital should be developed for the real estate market instead of relying only on bank credit.

Source: CafeF