Viet Capital Securities (VCSC) became the major shareholder of SCR

On June 12th,2019, Viet Capital Securities (VCSC, HoSE: VCI) officially became the major shareholder of Saigon Thuong Tin Real Estate (TTC Land, HoSE: SCR) after owning 19 million SCR shares, equivalent to 5.6% of the outstanding shares. The transaction was conducted according to the agreed method from June 7th to June 12th, with an agreed price of VND 8,000 (about 7% higher than the reference price of SCR of VND 7,500), VCSC spent about VND 152 billion for this venture.

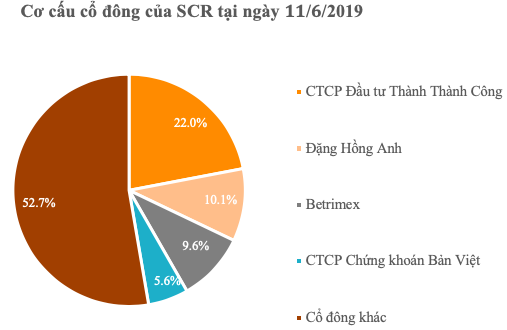

Thus, VCSC is the fourth biggest shareholder of TTC Land, together with Thanh Thanh Cong Investment owning 22% shares, Mr. Dang Hong Anh owning over 10% shares and Betrimex owning 9.6% shares. After this venture, VCSC plans to support TTC Land with a special strategy of banking investment activities in the capital market through financial tools such as equity, debt, and public hybrid instruments.

In the market, after a long-time decline, SCR shares have increased again recently. It has been reported that TTC Land is planning to call for capital from other major strategic shareholders, especially foreign investors such as investment funds, etc.

Regarding TTC Land, in addition to residential real estate, the company is also targeting the commercial center- office segment and industrial zone. The compounded annual growth rate of the company's revenue in the period of 2015-2018 is relatively good in the context of Vietnam's market fluctuations.

In 2019, TTC Land targets to achieve VND 2,969 billion in revenue with a slight increase of 1.4% compared to the revenue achieved in 2018. Consolidated pre-tax profit is estimated at VND 340 billion with the expectation to pay dividend ratio not lower than 7%. Base on the above criteria, the company plans to sell about 3,500 residential and commercial real estate products and to lease 3,200m2 of commercial floor. Particularly in the quarter 1/2019, profit increased sharply to VND 90 billion, accordingly TTC Land's profit rate increased significantly.

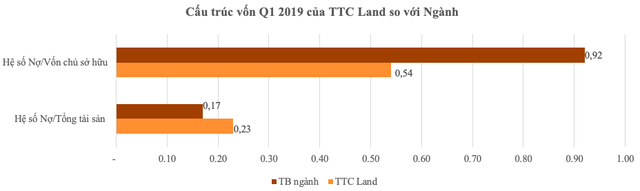

As of the end of quarter 1 this year, leverage ratio of Debt / Equity is 0.54 times (compared to the average level of enterprises in the same industry is 0.92 times). The ratio of debt / total asset is 0.23 times, and it is equivalent to the industry’s average ratio.

Recently on April 23rd, the company decided to appoint Mr. Nguyen Dang Thanh, Former Deputy General Director of Sacombank to officially hold the position of Chairman cum CEO of TTC Land, replacing Mr. Bui Tien Thang.

With his new position at TTC Land, Mr. Thanh will be responsible for strategic direction of organizational restructuring and simplifying the management system as well as promoting business, managing and utilizing capital, calling for participation of foreign investors.

Source: CafeF