TTC Land (SCR): Owning an idle land fund of over 1,700 hectares with expectation that large shareholder outside Thanh Thanh Cong Group will hold from 15 to 20% of the shares

Recently, TTC Land (SCR) continued to announce the transfer of nearly 3 million shares in Binh Tay Packaging and Warehouse Joint Stock Company with a total expected value of over VND 34.5 billion.

In the context that the real estate industry generally and businesses particularly are structuring capital as well as products amid a risky market situation, TTC Land (SCR) gained a lot of attention when continuously losing stock points, at the same time fluctuating sharply in personnel.

In the recent direct investment introduction, Phu Hung Securities (PHS) specially recognized the advantages of TTC Land after the cooperation with a strategic partner to develop the project, Lotte E&C - Korea with value the venture reaching approximately US $ 100 million, equivalent to VND 2,300 billion, accounting for nearly 67% of the company's charter capital.

15-20% of the shares will be held by major shareholders outside Thanh Thanh Cong Group

It is known that Lotte E&C - Korea will support the development of the 12 current TTC Land projects, focusing on the south and west areas with nearly 1 million m2 of construction floor, more than 6,441 products belonging to residential, commercial and office products. Lotte E&C is expected to invest about US $ 100 million in projects, shortly, USD 22 million will be "poured" into TTC Land in early 2020. Accordingly, TTC Land will do research and develop planning, accelerating the completion of legal procedures, buildup clean land fund for project development.

“With the financial strength and well-known brand, Lotte E&C will build business structure, finance and arrange capital for the project besides participating in the design, construction and marketing of the project” PHS commented.

Established in 1959, Lotte E&C has had remarkable growth for decades, recording nearly USD 5.5 billion in revenue, USD 4.5 billion in total assets, and is the leader in housing market. in Korea with the supply of more than 20,000 houses each year.

Previously, around June 2019 Viet Capital Securities (VCSC, VCI) also officially became a major shareholder of TTC Land after spending VND 150 billion to own 19 million shares. Currently, VCSC has been supporting investment banking activities through financial instruments such as equity, debt, and complex financial instruments (Hybrid Instruments).

In order to be highly efficient in the restructuring strategy, TTC Land's orientation in the period of 2019-2020 is that 15-20% of shares will be held by major shareholders held outside Thanh Thanh Cong Group, reducing the proportion of floating stocks in the market.

Currently, the stock is still at lowest level within 4 years comparing with 5,780 VND / share, after the recovery effort on November 26, 2019, liquidity has been highly increasing.

Idle land fund remains up to 1.754 hectares

On the other hand, the advantage of TTC Land lies in the idle land fund that the company is owning with nearly 1,754 hectares, especially the diversity from industrial parks, resorts and civil areas, accounting for 89% and trade volume. commerce - office, logistics about 11%, analysts said.

Currently, this land fund is located mainly in Tay Ninh, Kien Giang, Long An, Ho Chi Minh City and Dong Nai with 99.9%. Among that, Ho Chi Minh City recorded the demand for real estate always existing and growing steadily. In addition, Tay Ninh, Long An and Dong Nai are important satellite cities when proving their position for many years to be in the list of attractive cities for FDI capital.

Up to now, TTC Land has completed and handed over 15 projects with 6,459 products, accounting for 50% of the total number of products in the company’s portfolio of handover and developing, in 15 years of operation. The majority of products handed in the Western and the Southern areas accounts for 96% and the rest locate in the Eastern side.

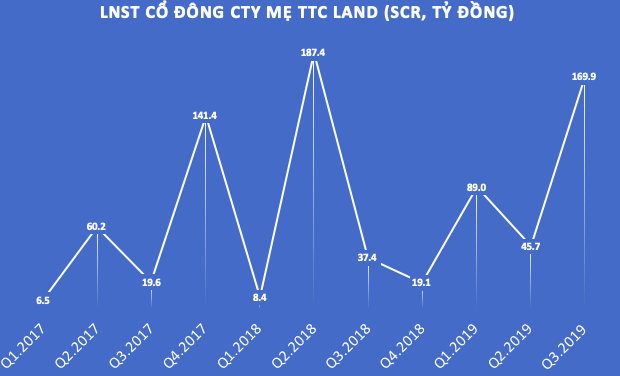

Accumulating In the first 9 months of, TTC Land achieved net revenue of VND 739 billion, decreasing 64% compared to the first 9 months of 2018; Profit after tax is VND 307 billion dong, increasing by 47% over the same period last year, in which profit after tax from parent company is VND 203 billion dong.

Growth was mainly arisen in third quarter. TTC Land recorded a large financial amount of profit from the transfer of Hai Phong project (after nearly 18 months of holding), divestments from member companies that own small-scale projects in areas where TTC land does not have competences, etc.

Recently, TTC Land (SCR) continued to announce the transfer of nearly 3 million shares in Binh Tay Packaging and Warehouse Joint Stock Company with a total expected value of over VND 34.5 billion.

Officially joining TTC Land after more than a half year, Chairman Nguyen Dang Thanh admitted that he was really under pressure because he had to lead a company in the restructuring phase amid the elusive real estate market. Particularly, but for being responsible in key positions at the same time in many previous companies, Mr. Thanh shares that he could always build a long-term vision. For real estate, the biggest risk is legal change, as a result, the leaders can hardly see or control the future but be flexible in all situations.

"The most difficult obstacle for TTC Land now is defining what to restructure, especially in finding people who are suitable for the challenges. In terms of human resources, TTC is implementing a recruitment program for the transition period to create new trends for the company.

As for business, when being immersed into real estate business, the principle is that we build and then sell, we must have a clear business philosophy to be true in making real estate, which means long-term ", Mr. Thanh said.

Source: CafeF